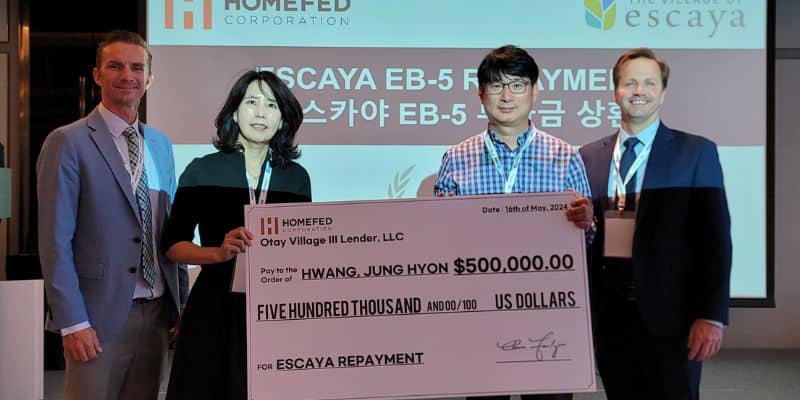

During the EB-5 & Global Immigration Pitch Day in Seoul and Shanghai, real estate development company HomeFed Corporation celebrated the first early repayments to EB-5 investors in their Village of Escaya project, the first part of a master-planned community in San Diego.

“The last repayment celebration I experienced at an EB-5 Investors Conference was with CanAm in 2018, and now we are seeing more and more repayments. This fact alone makes me excited to be in the EB-5 space”, said Nicholai Hinrichsen, who has spearheaded many of the investor filings for HomeFed.

Homefed’s President, Chris Foulger, and Director of EB-5 Financing, Trevor Anderson, recognized the investors on stage to personally celebrate their immigration journeys and success stories.

Four of the first eight EB-5 investors eligible for early payback for this project participated in the event. They were represented by Korean migration agencies Club Immigration and Abraham Emigration.

The repayment is a significant milestone for HomeFed as it marks their first EB-5 project and “one of the first senior loan Eb5 products in the market back in 2016”, said Foulger, also “we are setting a precedent for the industry as a developer and Regional Center combo paying back investors early”, according to Foulger.

“We are building a beautiful city within the city of San Diego, California; and we have now used the capital to build the project like we said we would. Now the loan is due, and we’re happy to repay people.” Foulger explains.

Anderson adds, “We’re just proving ourselves as a valuable EB-5 partner, a quality, trusted partner.”

EB-5 investor-friendly senior loan structure helped in early repayment

Several factors facilitated this early repayment, including Escaya’s conservative capital structure that prioritized the interests and capital of the EB-5 investors when structuring the loan and HomeFed’s financial stability.

“The loan placed investors in the senior position first with low leverage, allowing home sales and apartment sales to easily repay the EB-5 loan,” Foulger said. “The project is successful, and it was set up to be very conservative for the investors to begin with, putting them in a senior position in the loan so that the likelihood of success was very high given the low leverage position that we put the investors in,” Foulger said.

Details Matter with underwriting an EB-5 project

HomeFed also provided a deed of trust to the EB-5 lender without being contingent on the full raise. “They were also the first and only developer to create the ‘extension prohibition’ provisions to the EB-5 loan agreement to ensure that loan extensions are only possible when the investors haven’t completed their sustainment period. They are one of the very few developers willing to refund the EB-5 money to the investors if their I-526 petitions were denied due to source of funds or path of funds issues,” Lily Zheng, a migration agent from Bether Capital adds.

Meanwhile, Anderson emphasizes the importance of investing at the right time in the San Diego housing market. “At the most fundamental level, there was a shortage of housing in San Diego. This project would have been successful with or without Eb-5 funds. Many development projects look to Eb-5 to help make a marginal project feasible. Our first and sole focus is making sure the real estate project fundamentally makes sense.”

The EB-5 industry’s advancement, partly due to the changes made by the Reform and Integrity Act of 2022 (RIA) to the EB-5 investor visa program, also played a crucial role in the project’s success and the possibility of paying investors before the loan’s due date, which is Sept. 30, 2024.

However, he cautions that paying investors earlier than the due date still needs to become standard practice.

“The norm would be to slowly roll out your repayment to investors after the due date. So, we’re proud to be able to jump the gun and repay the investors not only in a timely manner but ahead of schedule.”

About 80% of the investors in Escaya came from Vietnam and South Korea. Foulger says the migration agencies that assisted these EB-5 applicants in selecting the project also played a crucial role in its success.

“The agents have become more sophisticated in their due diligence efforts. Many have been in this business for a long time now, and they recognize how important reputation is and are gravitating towards safer projects with seasoned developers,” he adds.

Additionally, EB-5 developers are not required to report early repayments to the United States Citizenship and Immigration Services (USCIS). However, transparency and access to information are crucial for applicants considering the EB-5 visa. Therefore, early repayments provide insight into the performance and financial health of developers and project sponsors.

Anderson says, “We’re seeing a transition in the EB-5 industry overall, and we’re seeing better quality projects for investors. The RIA is playing a significant role, and we feel like we’re a leader in this evolution of the EB-5 program.”

Escaya investors need to have I-829 filed to be repaid

HomeFed has already repaid many of its eligible investors in Korea and Vietnam. Investors are in various stages of the EB-5 process; some of them are already eligible because they have already filed the I-829 form, which enables investors to obtain lawful permanent residency in the U.S.

“For Pre-RIA investors, the rules state that investors must have completed their conditional residency [I-485] and filed their I-829 to be eligible for repayment. About half of our investors in the Escaya project are eligible for repayment. We’ve repaid some already, and we’re looking forward to repaying the rest,” Anderson states.

DISCLAIMER: The views expressed in this article are solely the views of the author and do not necessarily represent the views of the publisher, its employees. or its affiliates. The information found on this website is intended to be general information; it is not legal or financial advice. Specific legal or financial advice can only be given by a licensed professional with full knowledge of all the facts and circumstances of your particular situation. You should seek consultation with legal, immigration, and financial experts prior to participating in the EB-5 program Posting a question on this website does not create an attorney-client relationship. All questions you post will be available to the public; do not include confidential information in your question.